I decided to write on this topic as I feel I have done my fair share of research and experiments to identify and recommend the top stock market data API. These market data APIs can be useful for anyone who is planning to get started experimenting with:

Algo-Trading (Algorithmic Trading)

Perform Technical analysis

Apply and Backtest your novel Trading Strategies

I trade Stocks and Options part-time alongside my full-time Software Engineering job. For quite some time, I have been building tools that minimize my effort to perform stock analysis and find suitable trades for the day. Because if I have to do some research manually daily for multiple stocks on my watchlist, I cannot scale my approach. When my watchlist grew to 20+ symbols, it became essential for me to automate finding the trades that qualify for my set criteria for a potential trade. I also wanted to see some relevant technical analysis around the entry and exit price based on my custom trading strategies.

All this automation is only possible when we have a good market data source. It is even better if it offers additional APIs that provide pre-computed technical indicators. So you don't need to reprogram a known strategy and avoid reinventing the wheel. Below I will list the top stocks and options market data APIs that I have experimented with personally. Most of these platforms have a free tier with limited functionality. For most people like me, the free tier of the following APIs is just enough. But as always, things can change radically based on your specific use-case.

1. Alpaca Data API

Alpaca is #1 on my list mainly because I haven't come across any real-time stock market quotes source that is easy to use. It offers both REST and Websocket streaming interface for real-time stock price quotes.

As mentioned in the Alpaca docs:

Alpaca Data API provides the market data available to the client user through the REST and WebSocket streaming interfaces. Alpaca Data API consolidates data sources from five different exchanges.

IEX (Investors Exchange LLC)

NYSE National, Inc.

Nasdaq BX, Inc.

Nasdaq PSX

NYSE Chicago, Inc.

Up until now, Alpaca used to offer the stock market data via Polygon.io APIs. But now, they also have their version of data API called the Alpaca Data APIs.

The main difference between Alpaca Data API and Polygon is the density of the data. While Polygon data is full volume consolidated from all exchanges in the U.S., Alpaca Data API consists of five exchanges listed above. Alpaca Data API satisfies most of the daily uses with enough accuracy as to the real-time price needs.

Although to use the real-time quotes from Polygon.io, you would have to open a live trading account with Alpaca, which has no fees.

Link to Alpaca Data API: http://alpaca.markets/data

2. Polygon

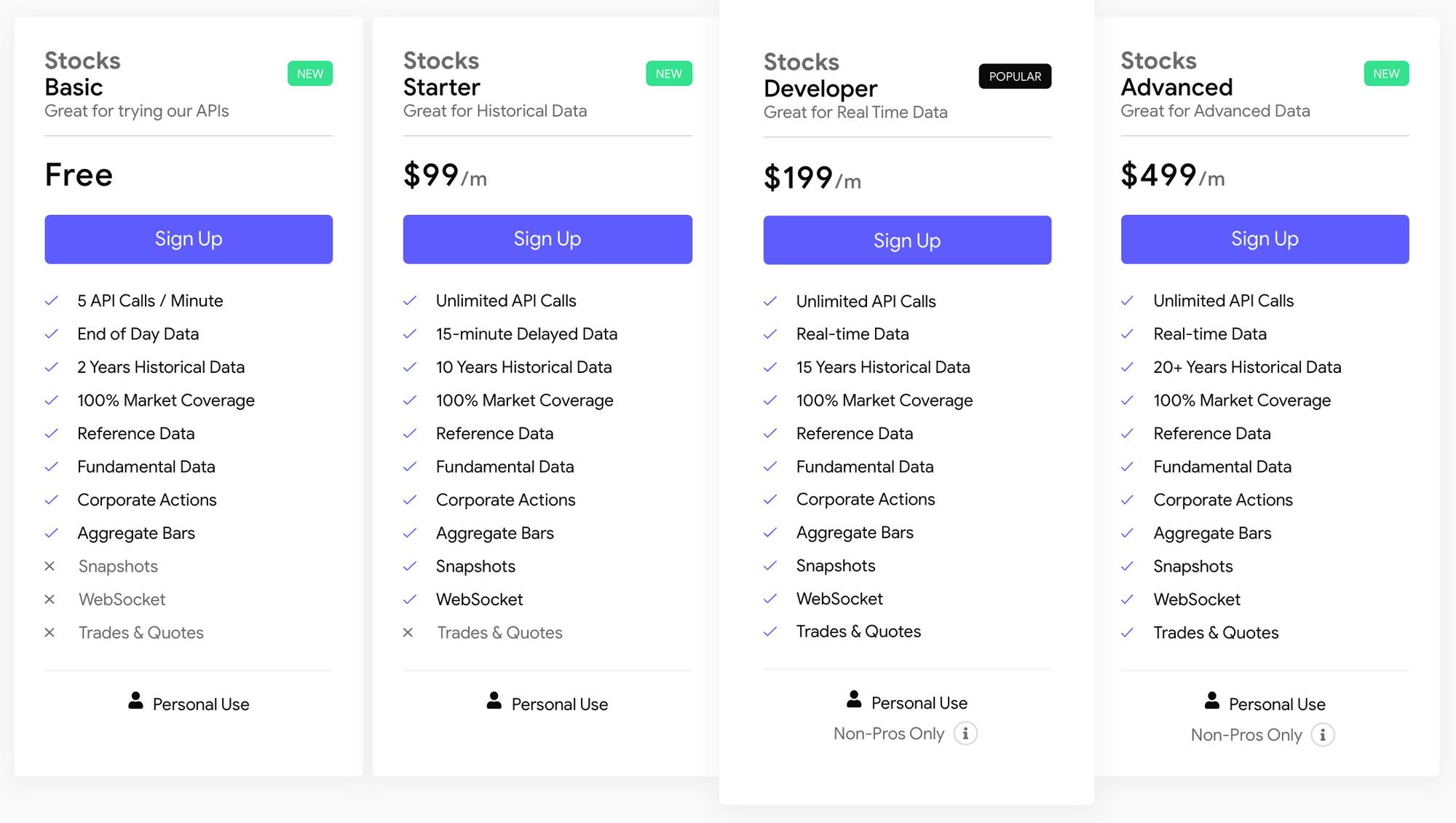

Polygon by-itself also offers a Free tier. Still, it only allows EOD (End of Day) data and only 5 API calls/minute and no WebSocket support. Depending on your trading strategy or algorithm, it might not be ideal for working with previous EoD data if you have to make intraday trading decisions.

Here is a screenshot of Polygon's pricing page captured as of Dec 2020:

Polygon API Pricing Info

My Verdict: I would go the Alpaca Data API route to access Polygon's real-time data APIs. I am using it this way as of today. All I had to do was enroll in a live trading account with Alpaca.

Link to Polygon REST API: https://polygon.io/docs/getting-started and Websockets: https://polygon.io/sockets

3. Alpha Vantage

Alpha Vantage provides a fantastic set of APIs. It includes almost all the market data APIs like intraday quotes, weekly and monthly time-series data. Apart from these usual APIs, it offers company fundamentals, cryptocurrencies, and forex data too. And to top it all, it provides APIs for pre-computed Technical Indicators. It had a huge list of indicators including but not limited to RSI (Relative Strength Index), Bollinger Bands (BB), MACD, Simple Moving Average (SMA), Exponential Moving Average (EMA), VWAP (Volume Weight Average Price), and so on... If I counted with my finger correctly, it offers 50+ Technical Indicator APIs.

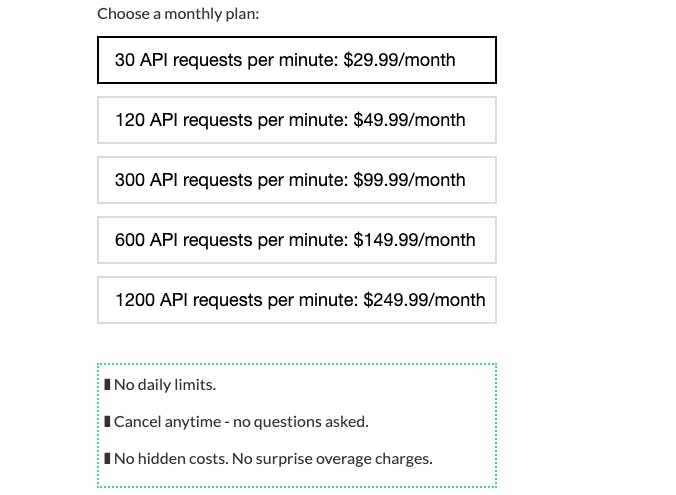

The free Alpha Vantage free tier has a limit of 5 API calls per minute with no limitation on what API you could use. You can also use one of their paid tiers, as seen in the below screenshot on Dec 2020.

Alpha Vantage API Pricing Info

My Verdict: I mainly use AlphaVantage for its Technical Indicator APIs. It saves me a lot of time not pulling historical data and writing the algorithm myself for nearly the same result that is readily available.

Link to Alpha Vantage API: https://www.alphavantage.co/documentation/

4. Tradier

Writing about Tradier is exciting to me as I use it all the time to support my Options Trading Strategies. I use Tradier's APIs mainly for querying Options price quotes. Tradier has a pretty generous free tier that includes additional Options related data like Options Greeks and Implied Volatility data points. The only caveat with the sandbox tier of Tradier market data APIs is that it doesn't support streaming quotes and offers delayed (up to 15 minutes) price quotes.

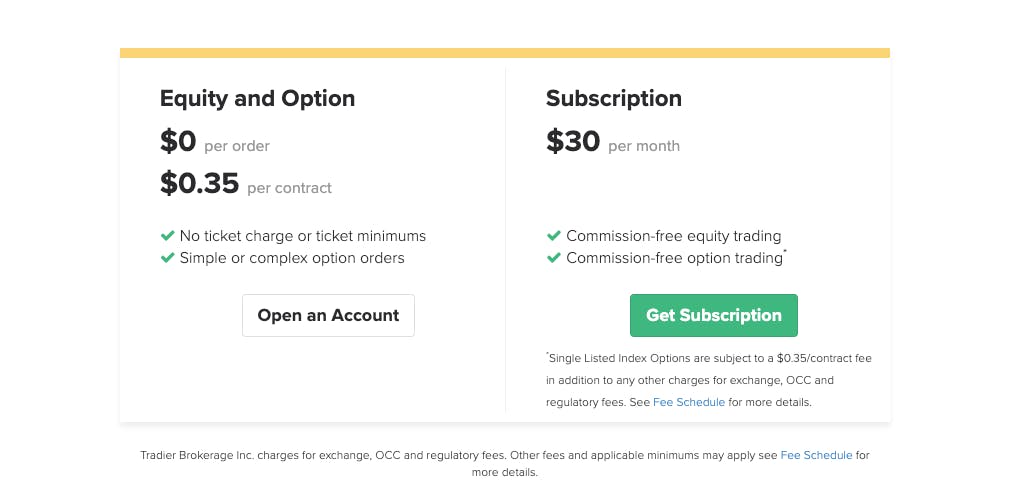

Tradier supports streaming quotes and real-time data if you open a brokerage account with them. You can also use their Trading APIs. You can read more about their transaction/ commission fees here: https://brokerage.tradier.com/pricing

Tradier Commission and Fee Info

Tradier is one of the OPRA (OPTIONS PRICE REPORTING AUTHORITY) vendors. Specifically, suppose you want to explore other vendors that might offer Options market data. In that case, you can explore the list of other OPRA vendors here: https://www.opraplan.com/

My Verdict: As mentioned before, I use Tradier heavily for programmatically finding my best options trading strategies, most commonly, the Wheeling Strategy (I will write a separate post on this later). Tradier's APIs are straightforward to use and gets the job done for me at no cost. In fact, it helps me make more money :) I plan to use their trading APIs in the future once I can completely automate my trading strategy, a.k.a Algorithmic Trading.

Link to Tradier API: https://documentation.tradier.com/brokerage-api/overview/market-data

To Conclude...

I listed out for you, in my view, the best sources and APIs for Stock and Options Market Quotes. Please make sure to try out each one of them and weigh the pros & cons of each based on your use case. My use-cases for Technical Indicators and Delayed Options quotes are satisfied well enough by Tradier and Alpha Vantage. I am not into High-Frequency Trading yet and don't plan to, as I know I will most likely never have an edge of doing that. But I am very much into using Technical Indicator that acts as soft decision-makers to guide my trading strategies. More on the Options trading strategies in a future post.

Disclaimer: Please review the terms of service of the respective API you are trying to use, especially if you will use it for commercial purposes.

How to earn a free stock?

If you haven't already signed up for a Robinhood Trading account, you can do so by using my referral link: https://join.robinhood.com/kashyab.

Happy Trading :)